Chart of the Week

Archives:

ROI Grows as

Alliance Experience Increases

Not All Alliances Are Strategic

Success Increases With Experience

Alliances Growing as a Source

of Revenue

ROI is Higher for Alliances

Alliances Result in Higher

ROE

US

Alliances Becoming More "Strategic"

Roadmap

to Alliance Success

Alliance Framework-Best Practice

Diagnostic

Europe and Asia See U.S. as

Behind in Integration and Implementation

What Europeans Do Better

Alliances Issues/Concerns Vary

by Region

Alliances Relevant to All Industries

Alliances Average $48 Million

Investment

Most Firms Evolve Their Alliance

Capability

Successful

Alliance Companies Depend More on Alliances for Growth

High Success Alliance

Companies Average 90% Success Rate

Successful Alliance Companies Earn More Profits on their Alliances

Successful Companies Do More Assessments of Both Themselves and

Partners

Successful Alliance Companies are More Disciplined in Following

a Process

Successful Alliance Companies Do Better at Integration Planning,

Bargaining Power, and Leverage Assessment

Many Companies Are Moving to Capture Alliance Best Practices,

With More Focus Externally

Successful Companies Are More Likely to Have Only Corporate Functional

Alliance Groups

Alliances at Successful Companies Report More to Top Management

Industry Agenda Drives Relevance of Cross-Border Alliances

Hence US Less Active in Cross-Border

Forces Shaping Alliances -- Filling Capability Gaps

Primary Alliance Drivers: Globalization and Capability Gaps

Challenges Specific to Alliance Drivers

HP Recognized the Importance in Capturing Strategic Alliance

Best Practices

Alliance Framework-Best Practice Diagnostic

Evolution of Websites

Only a Third of the Companies Offer Alliances Training

Examples of Electronic Knowledge Exchanges

Companies are Choosing Different Alliance Organization Solutions

Racing Toward Global Capabilities

Forces Shaping Alliances: Globalization of Markets

Successful

Alliance Companies Are More Focused on Alliances Which Are Strategic

Almost Everyone Believes Alliances Will Continue to Grow in Importance

Growth Driven by Both Number and Size of Alliances

Experience Drives ROI in Most Industries

Electronics Industry -- "Explosion of Dust" Leads

to Lower Returns

But Electronics Now Learning from Past Mistakes

Alliance Announcements Move the Market

Looking for Trends in Other Countries

Strategic Alliances More Complex to Negotiate

US Companies View Alliances More Positively

Drivers and Rationale -- Understanding from Both Partners' Perspectives

Seeds of Alliance Failure Sown Long Before Agreements Are Signed

100 Best Practice Diagnostic Elements

Alliance Framework -- Best Practice Diagnostic

Alliance Framework -- Tailoring the Approach

Corning Shows the Way: 48 Alliances

Foreign Alliance Skills Stronger Than U.S.

America Versus Europe and Asia: Key Alliance Success Factors

Evolution of Alliance Capabilities

We Understand What Successful Companies are Doing Differently

Forces Shaping Alliances -- Blurring of Industry Boundaries

Half of Recent Alliances Are Amongst Competitors

Command/Control Business Model Not

Appropriate for Alliance Era

Each Company Needs to Select Appropriate

Blend of these "Pure

Tone" Architectural Models

A New Business Model Is Emerging That Contains Elements of Control and

Cooperation

Gap Filling Dominates Strategic

Alliance Portfolio - But Cooperatives & Constellations Increasing

Example -- The Future of Global

Airlines "Cooperative"

The New Allianced Enterprise Will

Build on the Concepts of the "Global

Core"

Successful Companies Are More Likely to Have Only Corporate Functional

Alliance Groups

Alliances at Successful Companies Report More to Top Management

AOL Stock Rises on Alliance News, but Falls on Merger News

Growth Is Number One Reason For Alliances For Top 2000 US and European Firms

Growth Is Number One Reason For Alliances For Members of ACG

U.S. Will Continue to Grow as We Follow the Pattern in Europe

Successful Alliance Companies Place Bigger Bets in Their Alliances

Smaller Firms Are Achieving Even Higher ROIs Than Larger Companies

Successful Alliance Companies Are Much More Profitable

Strategic Alliances Attractiveness Versus

IPOs, Venture Capital and

Mezzanine Financing

This Preference is Greatest in Companies that Have Achieved Success with

Alliances

Over 50% of Fortune 500 Companies Are Shrinking, not Growing

High

Growth Companies are More Alliance-Intensive

Also High ROI Companies are More Alliance-Intensive

Alliances Yield Superior Growth & Profitability Without Trade-offs

Investors Recognize this Growth Problem

Mix of Alliances Shifting to Equity Alliances

Most Publicly Announced Equity Alliances are Non Internet Related

Equity Alliances Are Impacting All Industries

Foreign Companies Participate in Nearly 80% of all Equity Alliances

Japanese Have Used Cross-Corporate Alliances for Decades

Case Study: Nestlé's Ice Cream & Confectionary

Business--Drag on Growth

Corporate Alliances Fueling Growth in other

Businesses for Nestlé

Nestle Creates ICP JV (50/50) with Haagen-Daaz to Rejuvenate Business

Alliances Extended to Dreyers--Allowing Nestle to Become New Market Leader

BellSouth: Platform JV to Enter German Wireless

Market & Generate Record

Gain

Wal-Mart & Cifra

Leapfrog Competition Through Equity Alliance

Fuji Xerox Evolved from Shared Resource Alliance to 50/50 JV to Source

of Capital

As Less Risky Corporate Growth Vehicle, Alliances Now Outnumber Acquisitions

Acquisitions Too Often Fail to Accelerate Growth or Increase Shareholder

Value

Investor

Reaction to Acquisitions Has Been Unfavorable

Vivendi Acquisition Spree Did Not Increase Shareholder Wealth

Investors are Taking Note of M&A Failures

and Major Write-Downs

Alliances are Better to Launch New Businesses and Enter New Markets

In Past 10 Years, Median Partner Equity Investment Risen from $28MM to

$90MM

Median Partner Buyout in an Equity Alliance is $350 Million

Market Collapse Depressed Equity Alliance Investment, but Returns Increasing

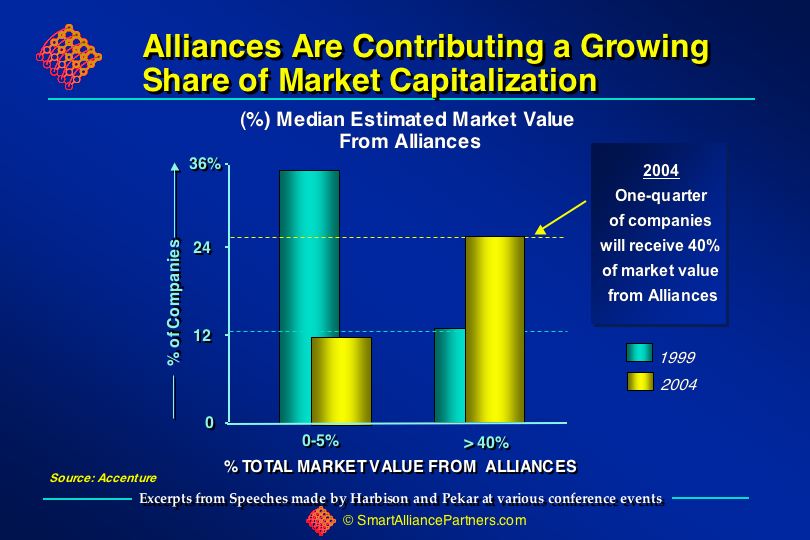

Alliances Are Contributing a Growing Share of Market Capitalization

|